We’d like to introduce a new feature for strike selection on algotest.in, we call it “ATM Straddle Width”.

How to get the ATM straddle price?

If you don’t already know what ATM and straddle mean in the context of options trading, we advise you to first read and understand those terms (google is your best friend) before coming back to read the rest of this blog.

For the sake of completeness, ATM stands for at-the-money, and a straddle is an options position which involves buying or selling a call and a put with the same underlying, strike and expiration.

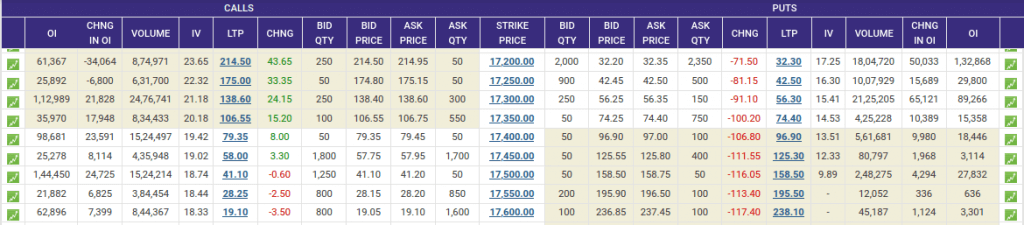

Below is a screenshot of the NIFTY options chain with the NIFTY spot price at 17335. The way to pick the ATM strike is to find the strike price nearest to 17335, in this case the ATM strike is 17350.

So what’s the straddle price? On algotest.in, we use the LTP to determine the straddle price. In this case, the 17350 Call LTP is 106.55, and the put LTP is 74.40, which makes the straddle LTP = Rs 180.95. This is our ATM straddle price.

“ATM Straddle Width”

The “ATM Straddle Width” is just another name we coined for the ATM straddle price. Straddle Width seems more intuitive to us when we use it in the context of picking strikes that represent the wings.

Straddle Width Multiplier (or Multiplier)

We combine this multiplier value with the ATM Straddle Price to select new strikes. This is best demonstrated using two common use cases:

- Selecting the strike of an upside (OTM) call:

- The formula becomes: New Strike = ATM Strike + ATM Straddle Width * Multiplier

- So in the above image, if Multiplier = 0.5, New Strike = 17350 + 180.95 * 0.5 = 17440, round this to the nearest strike and we get New Strike = 17450

- Selecting the strike of a downside (OTM) put:

- The formula becomes: New Strike = ATM Strike – ATM Straddle Width * Multiplier

- So in the above image, if Multiplier = 0.5, New Strike = 17350 – 180.95 * 0.5 = 17259, round this to the nearest strike and we get New Strike = 17250

To summarise, the two strikes we ended up selecting with Multiplier = 0.5 are 17250 and 17450.

We’ve built a google sheet that can help you visualize this – https://bit.ly/3qVoiOW. Since this sheet is read-only, all you need to do is to copy all the contents over to a new google sheet. In the new sheet, you can tweak the ATM Strike, the ATM Straddle Price, the Sign and the Multiplier to observe how this formula evolves. Here is a video also explaining this feature – in Hindi, and English.

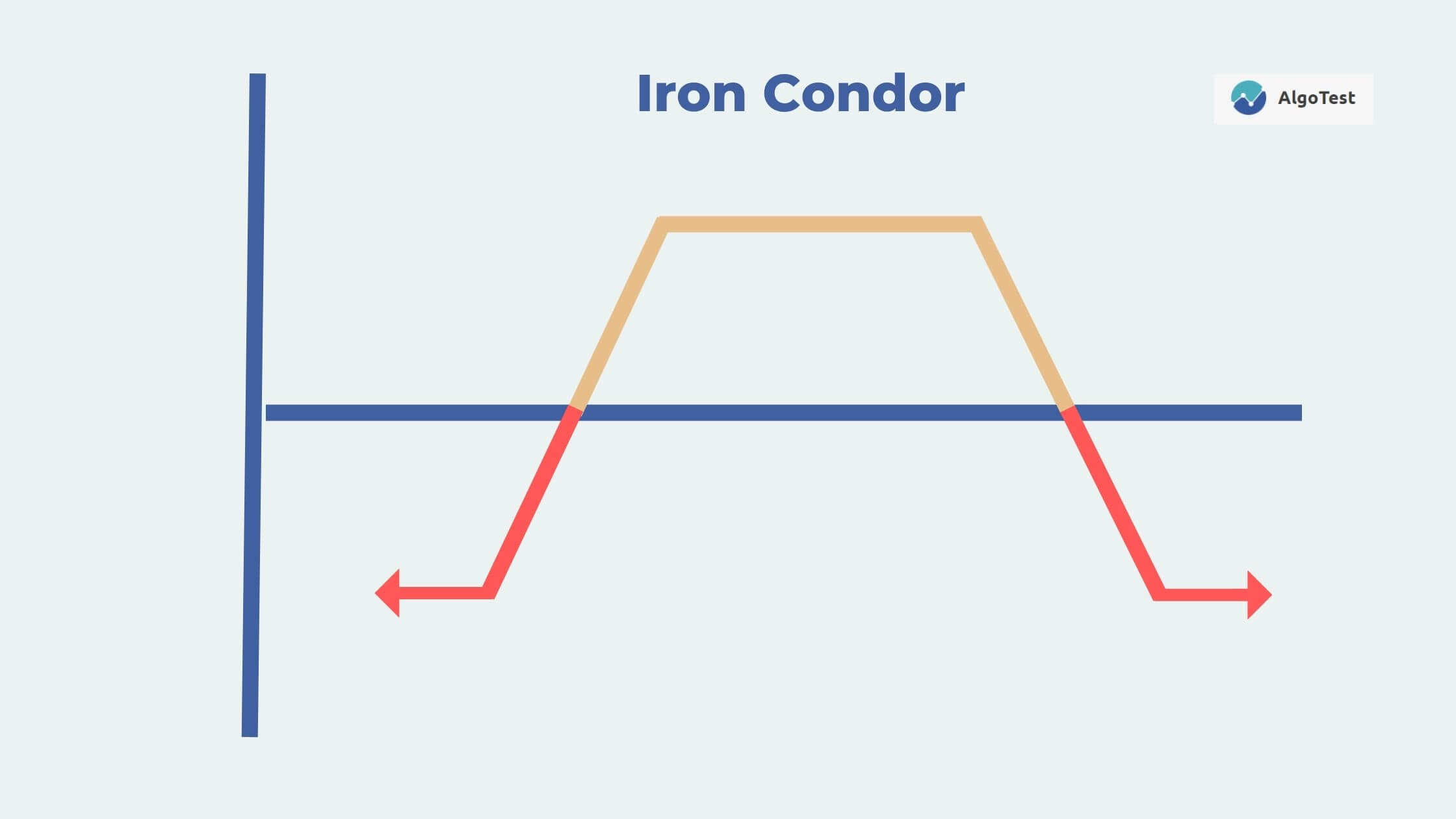

An Iron Condor Strategy using Straddle Width

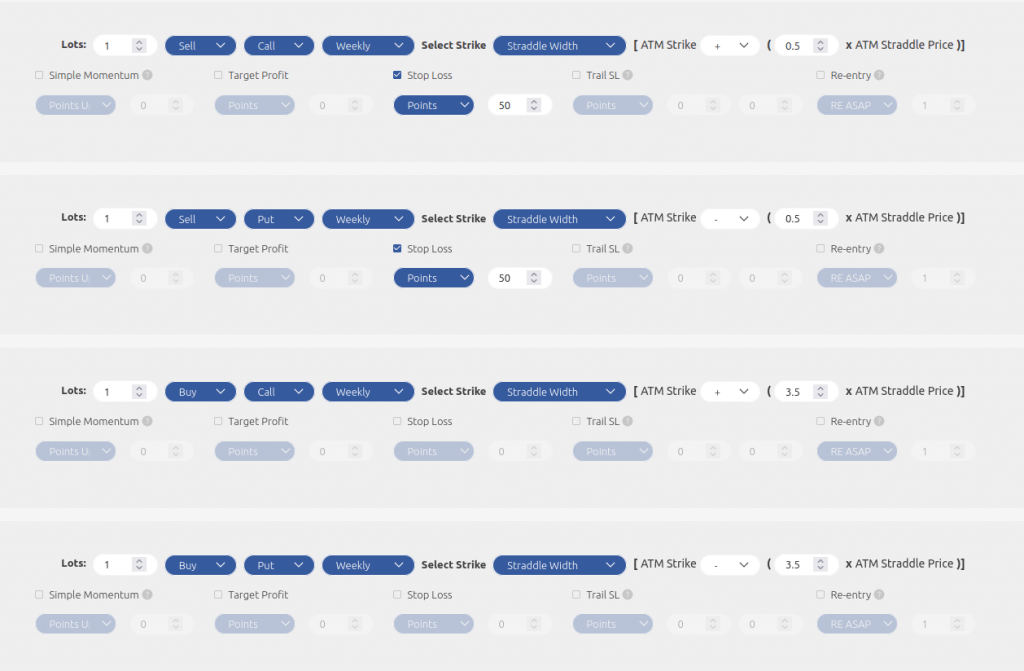

Here is a screenshot of a sample way in which you can use this feature:

Other parameters for this strategy we have chosen are:

- Entry Time = 9:35am

- Index = Banknifty

- Square off=Partial.

With these parameters, the total approx margin required for this trade is Rs 75,000. Check out how this strategy performed during the last 5 years by clicking “Start Backtest”. Not bad for such a simple setup. Now will this setup continue to make money? Maybe, maybe not.

Some Observations

We can make the following general observations here in the context of the strategy:

- If ATM vol is constant, a high ATM straddle price (eg. on a Friday for weekly options) will correspond to wings which are farther away from the ATM strike, i.e. wider. So in the context of a short iron condor strategy, your buy strikes will be further away from your short strikes vs on expiry day (Thursday)

- When atm vol is high, your long strikes will dynamically adjust further away from your short strikes.

We advise you to perform the same backtest on your own at algotest.in. Once backtested, you should download the results csv file and play around with it to build intuition around this strategy! Also, note that these results are simulated on historical data, and the backtest results could actually differ significantly from the historical performance of the algorithm or strategy.

10 thoughts on “Intraday Iron Condor Built Using Straddle Width”

after getting back test data , how the selection of day name change the gain/loss in the chart. but it does not show change in the downloaded file. please help to know how it works

Our downloaded file is static, it contains ALL the trades, irrespective of filters. So when you toggle the day of week (eg Monday, Tuesday, etc.), the change will only be reflected in the browser, and not in the downloaded file.

Pingback: Trail Stop Loss to Break-Even Price when Backtesting - AlgoTest

can we backtest calender trade. Selling in weekly and buying in monthly with straddle with of weekly?

You can sell in weekly and buy other legs in monthly. Please DM us on twitter or mail us at support@algotest.in to help us understand the kind of strategy you’d like to backtest!

I have deployed a strategy using Zerodha API, but while execution the system shows error (Strategy has been stopped due to unknown error=Error in placing order from broker side in order firing. Manual intervention is needed.)

Please resolve.

Hi, were you able to figure this out?

What happens to the buy hedge positions once one of the sold leg SL hits?

You can choose to square it off or ride it until market close. You can backtest both of these conditions on AlgoTest!

My following order is not executing properly. It is showing execution error.

Entry Time: 9:35 exit time: 3:15

Buy : Itm 4

simple momentum: underline percentage Move up – 0.2

Stop loss : underline percentage- 0.2

Sell : Otm 1

simple momentum: underline percentage Move up – 0.2

Square off : complete

I think sell order is executing first and due to low margin sell order is rejected.

Is there any way to deal with it.

As my trade need to execute buy leg order first than sell leg order.

I have executed the above trade in my father account (9569033449).

My phone no 9569969000